An Unbiased View of Whole Farm Revenue Protection

Table of Contents7 Easy Facts About Whole Farm Revenue Protection ExplainedSome Known Facts About Whole Farm Revenue Protection.The 10-Second Trick For Whole Farm Revenue ProtectionWhole Farm Revenue Protection Things To Know Before You Get ThisThe 10-Minute Rule for Whole Farm Revenue ProtectionWhole Farm Revenue Protection - The FactsThe smart Trick of Whole Farm Revenue Protection That Nobody is Talking About

Farm and also cattle ranch home insurance coverage covers the assets of your ranch as well as cattle ranch, such as livestock, tools, buildings, installments, as well as others. Think about this as industrial home insurance that's exclusively underwritten for companies in farming. These are the typical insurance coverages you can obtain from ranch and cattle ranch residential or commercial property insurance policy. The equipment, barn, equipment, tools, livestock, products, and equipment sheds are valuable possessions.Your ranch and also ranch uses flatbed trailers, confined trailers, or utility trailers to transport goods and devices. Commercial car insurance policy will cover the trailer however just if it's affixed to the insured tractor or vehicle. If something occurs to the trailer while it's not affixed, after that you're left on your very own.

Employees' compensation insurance coverage supplies the funds a staff member can use to purchase medications for a job-related injury or illness, as suggested by the medical professional. Employees' compensation insurance policy covers rehabilitation. It will likewise cover re-training expenses to ensure that your staff member can resume his work. While your worker is under rehabilitation or being educated, the plan will certainly supply an allocation equivalent to a percent of the typical weekly wage.

The 7-Minute Rule for Whole Farm Revenue Protection

You can guarantee on your own with workers' settlement insurance coverage. While buying the policy, providers will certainly offer you the liberty to consist of or omit yourself as an insured.

Whole Farm Revenue Protection - The Facts

The appropriate one for your farm vehicle and also circumstance will certainly vary depending upon a variety of elements. Several farm insurance policy providers will certainly also use to write a farmer's vehicle insurance. It can be helpful to couple plans together from both a protection and cost viewpoint. In anonymous some scenarios, a ranch insurance coverage provider will just supply specific sorts of auto insurance policy or insure the automobile dangers that have operations within a certain range or scale.

No issue what check this site out provider is composing the farmer's auto insurance coverage policy, heavy and extra-heavy vehicles will certainly require to be placed on a industrial vehicle policy. Trucks entitled to a business ranch entity, such as an LLC or INC, will need to be positioned on a commercial plan no matter the insurance coverage provider.

If a farmer has a semi that is made use of for carrying their very own farm items, they may have the ability to include this on the same industrial vehicle plan that insures their commercially-owned pickup. Nevertheless, if the semi is used in the off-season to carry the goods of others, many conventional farm and also commercial car insurance policy service providers will not have an "cravings" for this type of risk.

Not known Facts About Whole Farm Revenue Protection

A trucking policy is still a commercial auto policy. Nevertheless, the providers who use insurance coverage for procedures with automobiles used to haul items for 3rd celebrations are typically concentrated on this sort of insurance. These sorts of operations create greater dangers for insurance companies, bigger case quantities, and also a greater extent of insurance claims.

A seasoned independent agent can aid you decipher the kind of policy with which your business vehicle ought to be insured and discuss the nuanced implications and insurance policy ramifications of having multiple car plans with various insurance policy carriers. Some trucks that are utilized on the ranch are insured on personal vehicle policies.

Commercial lorries that are not qualified for an individual auto policy, however are utilized specifically in the farming operations offer a lowered danger to insurance provider than their business usage counterparts. Some providers choose to insure them on a ranch automobile plan, which will have a little various underwriting criteria as well as rating structures than a normal business auto plan.

Whole Farm Revenue Protection Fundamentals Explained

Type A, B, C, as well as D.

Time of day of use, miles from the home farmHouse and other restrictions apply limitations check my blog use types of vehicles. As you can see, there are several types of farm truck insurance coverage plans available to farmers.

The Buzz on Whole Farm Revenue Protection

It's crucial to review your automobiles as well as their usage honestly with your agent when they are structuring your insurance portfolio. This sort of thorough, conversational approach to the insurance policy acquiring process will help to make certain that all protection gaps are shut and also you are getting the greatest value from your policies.

Disclaimer: Details as well as claims provided in this material are meant for helpful, illustrative objectives and also ought to not be taken into consideration lawfully binding.

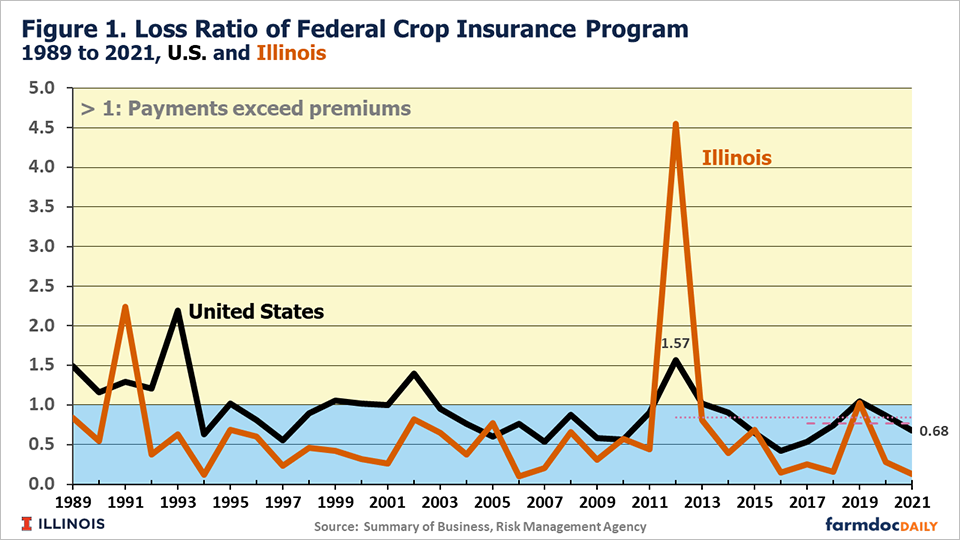

Crop hailstorm coverage is sold by private insurance providers and also regulated by the state insurance policy departments. It is not component of a federal government program. There is a federal program giving a range of multi-peril plant insurance coverage products. The Federal Plant Insurance program was produced in 1938. Today the RMA carries out the program, which supplied policies for greater than 255 million acres of land in 2010.

Excitement About Whole Farm Revenue Protection

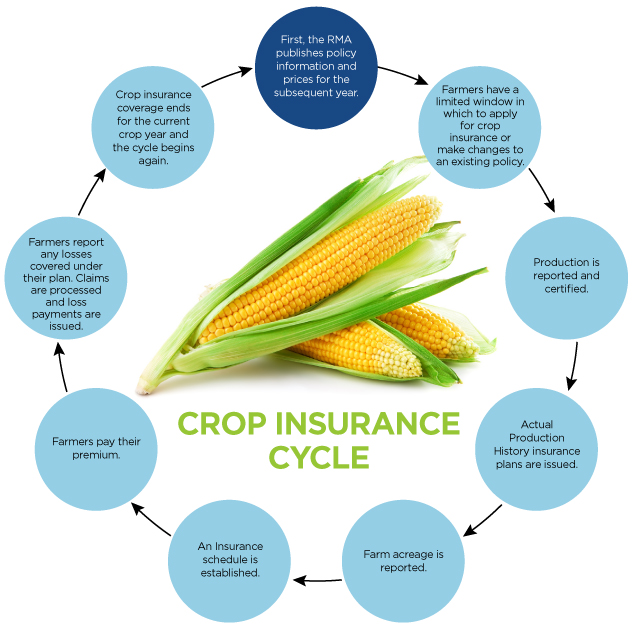

Unlike other types of insurance coverage, crop insurance is dependent on recognized dates that use to all policies. These are the essential dates farmers should expect to satisfy: All crop insurance applications for the marked region as well as crop are due by this day.